3 Park Avenue, 36th Floor

New York, NY 10016

[•],January 29, 2020

Dear Shareholder:

You are cordially invited to attend the Special Meeting of Shareholders (the “Meeting”) of CION Ares Diversified Credit Fund (the “Fund”) to be held at [•],the offices of Dechert LLP, located at 1095 Avenue of the Americas, New York, New York 10036, on [•], [•],Thursday, April 23, 2020 at [•] [AM/PM]9:00 a.m. Eastern Time. Please note that if you plan to attend the Meeting in person, photographic identification will be required for admission.

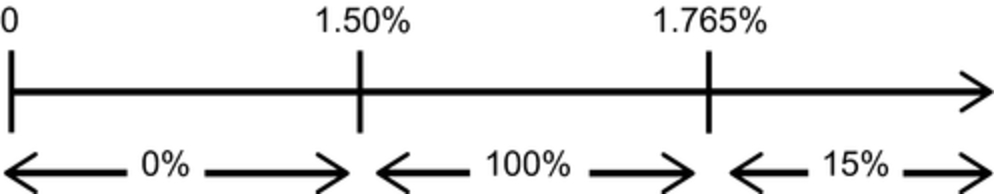

The Meeting is being held to consider (i) a proposal to approve the Third Amended and Restated Investment Advisory Agreement between the Fund and CION Ares Management, LLC (the “Advisor”) in order to modifymake certain technical changes to the calculation of the Fund’s incentive fee on net investment income. If these changes are approved by shareholders, the incentive fee such that it is calculatedwill be based on (a)(1) each share class’s net investment income (rather than Fund-level net investment income) and (b)(2) each share class’s net asset value (rather than the Fund’s “Adjusted Capital” (as defined in the Proxy Statement));.

The purpose of the first technical change to the calculation of the Fund’s incentive fee is to provide for more equitable treatment of shareholders of each share class and (ii)more closely align the incentive fee structure with each individual investor’s actual investment performance. This change could, under certain scenarios, cause shareholders that pay lower or no class-specific fees (i.e., shareholder servicing and distribution fees) to bear higher incentive fees, and could cause shareholders that pay higher class-specific fees to bear lower incentive fees. The purpose of the second technical change to the calculation of the Fund’s incentive fee is to reduce the complexity of the incentive fee calculation – which poses a significant operational burden on the Advisor. This second change is generally expected to have a neutral impact on incentive fees payable by the Fund and may result in higher or lower incentive fees depending on market events.

The Meeting is also being held to consider a proposal to approve the adjournment of the Meeting, if necessary or appropriate, to solicit additional proxies.

The accompanying Notice of Special Meeting of Shareholders and Proxy Statement include information relating to the proposals.

Your vote is extremely important to us. If you will not attend the Meeting in person, we urge you to sign, date and promptly return the enclosed proxy card in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States, or use the internet or telephone voting options to cast your vote.

On behalf of management and the Board of Trustees, we thank you for your continued support of the Fund.

Sincerely, | |

Michael A. Reisner | |

Co-President and Co-Chief Executive Officer |

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE OR USE THE INTERNET OR TELEPHONE VOTING OPTIONS TO CAST YOUR VOTE AS SOON AS POSSIBLE. YOUR VOTE IS IMPORTANT.